The Nuances of Inflation Management in the United Kingdom: A Comprehensive Analysis

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

Abstract

Inflation management represents a foundational responsibility for the Bank of England (BoE), tasked with the intricate balancing act of achieving its 2% inflation target while simultaneously fostering sustainable economic growth. This report undertakes an extensive examination of inflation within the United Kingdom’s economic landscape, dissecting its multifaceted nature, including various typologies and underlying drivers, its historical evolution, and the sophisticated methodologies employed for its measurement and forecasting. Furthermore, it scrutinises the comprehensive suite of monetary and fiscal instruments at the disposal of policymakers. A critical assessment of the efficacy and potential unintended consequences of these tools across diverse economic sectors is provided, offering a granular and nuanced understanding of the persistent challenges and strategic imperatives in navigating the complex terrain of inflation management. The analysis draws upon established economic theories, historical UK data, and contemporary policy debates to present a holistic perspective on this crucial economic phenomenon.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

1. Introduction

Inflation, fundamentally defined as the sustained rate at which the general level of prices for goods and services is increasing, concurrently leading to a decline in the purchasing power of currency, stands as a paramount economic indicator. Its fluctuations profoundly influence household budgets, business investment decisions, international trade competitiveness, and the overall stability of an economy. For the United Kingdom, the operational independence granted to the Bank of England in 1997 bestowed upon it a primary objective: to achieve and maintain price stability, explicitly defined by a symmetrical inflation target of 2% for the Consumer Price Index (CPI). This target is not merely an arbitrary number but is strategically chosen to provide a clear anchor for inflation expectations, mitigate price volatility, and thereby create an environment conducive to long-term sustainable economic growth and high employment.

However, the pursuit of this 2% target is rarely straightforward, involving a delicate and often complex navigation of intricate economic dynamics. Policymakers must continually weigh the imperative of inflation control against the equally vital objective of stimulating aggregate demand and supporting economic expansion, especially during periods of subdued growth or recession. The inherent tension between tightening monetary conditions to quell inflationary pressures and easing them to spur economic activity presents a perennial challenge. Factors such as global supply chain shocks, shifts in consumer behaviour, geopolitical events, and domestic labour market conditions all contribute to the volatility of inflationary pressures, demanding agile and well-informed policy responses.

This comprehensive report endeavours to unravel the multifaceted nature of inflation within the UK context. It begins by delineating the various theoretical types and empirical causes of inflation, moving thereafter to a detailed historical analysis of the UK’s inflationary journey, replete with lessons from past crises and successes. Subsequent sections delve into the sophisticated methodologies employed by institutions like the Office for National Statistics (ONS) and the Bank of England for the rigorous measurement and accurate forecasting of price level changes. A substantial portion of the report is dedicated to an in-depth exploration of the primary policy instruments – both monetary and fiscal – that are leveraged to manage inflation, scrutinising their operational mechanisms, historical application, and potential effectiveness. Crucially, the analysis extends to a critical evaluation of the often-unintended side effects and distributional impacts of these policy interventions on various segments of the economy and society. By integrating theoretical frameworks with empirical evidence and contemporary policy considerations, this report aims to provide a robust and nuanced understanding of inflation management in the UK, underscoring the complexities and strategic imperatives faced by policymakers in their continuous quest for economic stability and prosperity.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

2. Types and Causes of Inflation

Inflation is not a monolithic phenomenon but manifests in various forms, each driven by distinct economic forces. Understanding these types is crucial for diagnosing inflationary episodes and formulating appropriate policy responses.

2.1 Demand-Pull Inflation

Demand-pull inflation arises when the aggregate demand for goods and services in an economy collectively outstrips the economy’s capacity to produce them at current price levels. This scenario typically emerges during periods of robust economic expansion, where strong consumer confidence, buoyant business investment, expansive government expenditure, or a surge in net exports collectively drive up overall demand. When an economy approaches or exceeds its potential output – the maximum sustainable level of output without generating inflationary pressures – any further increase in demand cannot be met by increased supply. Consequently, producers respond by raising prices, as they face limited capacity and perceive a strong willingness of consumers and businesses to pay more.

From a macroeconomic perspective, this can be visualised through the aggregate demand (AD) and aggregate supply (AS) model. If the AD curve shifts outwards beyond the point where the AS curve becomes relatively inelastic (i.e., near full employment or potential output), the primary adjustment mechanism is through price increases rather than output expansion.

Key drivers of demand-pull inflation include:

- Increased Consumer Spending (C): Driven by factors such as rising real wages, easy access to credit, wealth effects from appreciating asset prices (e.g., housing, stocks), or a general improvement in consumer sentiment and expectations about future income. For instance, post-pandemic economic reopenings saw significant pent-up demand contribute to inflationary pressures as consumers spent accumulated savings.

- Increased Investment (I): Businesses expand capital expenditure when they anticipate strong future demand and profitability, often spurred by low interest rates, technological advancements, or favourable tax policies. This demand for capital goods can also push up their prices.

- Increased Government Spending (G): Fiscal stimulus packages, such as those implemented during recessions or crises, inject money directly into the economy, boosting aggregate demand. Examples include infrastructure projects, increased public sector wages, or transfer payments. While effective in mitigating downturns, excessive or untargeted fiscal expansion can become inflationary if supply constraints are binding.

- Increased Net Exports (NX): A weaker domestic currency makes exports cheaper and imports more expensive, leading to an increase in foreign demand for domestic goods and a decrease in domestic demand for foreign goods. This shift can boost aggregate demand and, if the economy is near full capacity, contribute to demand-pull inflation.

Historically, periods of rapid economic growth, often associated with credit booms, have frequently been accompanied by demand-pull inflationary pressures. Policymakers monitor indicators such as capacity utilisation rates, unemployment levels (especially the Non-Accelerating Inflation Rate of Unemployment, NAIRU), and consumer confidence indices to gauge the extent of demand-side pressures.

2.2 Cost-Push Inflation

Cost-push inflation, in contrast, originates from the supply side of the economy. It occurs when increases in the costs of production inputs are passed on to consumers in the form of higher prices for final goods and services, even if aggregate demand has not necessarily increased. Producers face higher operational expenses and respond by reducing supply or increasing prices to maintain profit margins. This can be conceptualised as a leftward shift in the aggregate supply (AS) curve, leading to higher price levels and lower output, a phenomenon sometimes referred to as ‘stagflation’ if economic growth simultaneously stagnates.

Primary contributors to cost-push inflation include:

- Rising Raw Material Costs: Significant increases in the prices of key commodities, particularly energy (oil, gas) and food, have historically been major drivers. The oil price shocks of the 1970s are prime examples, where dramatic increases in crude oil prices fed through to higher transport costs, manufacturing expenses, and utility bills, leading to widespread inflation across advanced economies. More recently, geopolitical events like the Russia-Ukraine war have triggered substantial spikes in global energy and food commodity prices, impacting UK households and businesses directly.

- Increasing Labour Costs (Wage Push): When wages rise faster than productivity gains, unit labour costs increase. If firms pass these higher costs onto consumers, it contributes to inflation. This can be driven by strong trade union bargaining power, labour shortages, or increases in minimum wage rates. If wage increases are seen as catching up with previous price rises, it can lead to a ‘wage-price spiral’, bridging cost-push and built-in inflation.

- Supply Chain Disruptions: Globalisation has made economies more interconnected but also more vulnerable to disruptions. Events like natural disasters, pandemics (e.g., COVID-19-related factory closures and shipping delays), or geopolitical tensions can disrupt supply chains, leading to shortages of components and finished goods. Reduced availability coupled with existing demand forces prices upwards.

- Imported Inflation: For open economies like the UK, a depreciation of the domestic currency (e.g., the Pound Sterling) makes imported goods and services more expensive when measured in local currency. Since many UK businesses rely on imported components, energy, and finished goods, a weaker pound can directly translate into higher input costs and consumer prices. Non-tariff barriers and increased trade friction can also add to import costs.

- Regulatory Costs: New environmental regulations, health and safety standards, or increased taxation on certain industries can raise firms’ compliance costs, which may then be passed on to consumers.

2.3 Built-In Inflation (Wage-Price Spiral)

Built-in inflation, often referred to as a wage-price spiral or inflationary expectations, represents a self-perpetuating cycle where past inflation influences current and future inflation. It arises from the adaptive expectations of economic agents. Workers, observing rising living costs, anticipate continued price increases and demand higher wages to maintain their real purchasing power. As these wage demands are met, businesses face increased labour costs. To protect profit margins, firms then raise the prices of their goods and services. This further exacerbates the cost of living, prompting workers to demand even higher wages in the next bargaining round, thus perpetuating the cycle.

This phenomenon is particularly insidious because it can sustain inflationary pressures even in the absence of new demand-side or supply-side shocks. It becomes deeply embedded in the economy’s structure through indexing mechanisms (where wages or benefits are automatically adjusted for inflation) and through collective bargaining agreements that anticipate future inflation. Central banks pay close attention to measures of inflation expectations (e.g., from surveys, bond markets) because well-anchored expectations – where people believe inflation will return to target – are crucial for breaking this spiral. If expectations become de-anchored, the costs of bringing inflation back down can be significantly higher, often requiring more aggressive monetary policy tightening that risks a recession.

2.4 Other Nuances of Inflation

While demand-pull, cost-push, and built-in inflation are primary categories, other perspectives and specific drivers are also relevant:

- Monetary Inflation: Rooted in the Quantity Theory of Money (MV=PT, where M is money supply, V is velocity of money, P is price level, T is transactions or real output). This theory posits that if the money supply grows significantly faster than the rate of real output, it will primarily result in higher price levels. Excessive creation of money by a central bank or government, particularly when not backed by increased production, can lead to a devaluation of the currency and general price increases. While often a long-run phenomenon, it can interact with demand-pull pressures in the short-to-medium term.

- Asset Price Inflation: This refers to the sustained increase in the prices of assets like stocks, bonds, and real estate, rather than consumer goods and services. While not directly captured by CPI, it can have significant wealth effects, contributing to demand-pull inflation in consumer markets. It can also pose risks to financial stability.

- Sectoral Inflation: This occurs when inflation is concentrated in specific sectors of the economy, such as housing, healthcare, or education, due to particular supply and demand imbalances within those sectors. While not necessarily indicative of broad economy-wide inflation, persistent sectoral inflation can eventually spill over into the general price level.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

3. Historical Trajectory of Inflation in the UK

The UK’s economic history provides a rich tapestry of inflationary experiences, ranging from periods of hyperinflation to sustained disinflation, each shaped by a confluence of domestic policy choices, global economic forces, and unforeseen shocks.

3.1 Post-War Period to the 1970s: The Age of Stagflation

Following the Second World War, the UK, like many Western economies, entered a period characterised by reconstruction and the embrace of Keynesian economic policies, which prioritised full employment and used fiscal policy to manage demand. For much of the 1950s and early 1960s, inflation remained relatively stable, averaging around 3-4%. This era was underpinned by the Bretton Woods system of fixed exchange rates, which provided a degree of international monetary stability. However, underlying tensions were building. Successive governments pursued expansionary fiscal and monetary policies, often leading to ‘stop-go’ cycles, where overheating demand led to balance of payments crises, forcing the government to ‘stop’ growth through deflationary measures.

This precarious stability shattered in the 1970s, which is widely regarded as one of the most turbulent periods for the UK economy, culminating in unprecedented levels of inflation coupled with stagnant growth – a phenomenon termed ‘stagflation’. The average annual inflation rate soared, peaking dramatically at 24.9% in 1975 [Office for National Statistics, Historical CPI series]. Several critical factors converged to create this environment:

- Breakdown of Bretton Woods: The collapse of the fixed exchange rate system in the early 1970s removed a key international constraint on monetary policy, allowing governments greater freedom but also increasing exposure to currency volatility. The pound depreciated, making imports more expensive.

- Wage-Price Spirals and Trade Union Power: Strong trade unions wielded considerable influence, successfully negotiating significant wage increases. These wage hikes, often exceeding productivity growth, were then passed on by firms as higher prices, leading to a persistent wage-price spiral. Government attempts to impose wage freezes or incomes policies proved largely ineffective and often led to industrial unrest.

- Expansive Fiscal and Monetary Policies: Governments continued to pursue expansionary fiscal policies, running large budget deficits and expanding the money supply, believing this would support employment. However, in an economy increasingly constrained by supply-side rigidities, this primarily fuelled demand-pull inflation.

- Oil Price Shocks: The most dramatic exogenous shocks were the 1973 OPEC oil embargo and the subsequent quadrupling of crude oil prices, followed by another significant price hike in 1979 after the Iranian Revolution. As a heavily oil-dependent economy, these shocks drastically increased production costs across all sectors, directly contributing to cost-push inflation and crippling industrial output.

- Productivity Slowdown: Alongside these shocks, the UK experienced a general slowdown in productivity growth, meaning that even moderate wage increases translated into higher unit labour costs, exacerbating inflationary pressures.

The combination of these factors led to a period where high unemployment and economic stagnation coexisted with runaway inflation, challenging the conventional Keynesian view of a stable Phillips Curve trade-off between inflation and unemployment.

3.2 1980s to Early 2000s: Monetarism, Independence, and the Great Moderation

The economic turmoil of the 1970s prompted a radical shift in UK economic policy. The Thatcher government, elected in 1979, abandoned the Keynesian consensus in favour of monetarism, focusing on controlling the money supply as the primary means to combat inflation. Initial policies involved tight monetary targets and severe fiscal restraint, which, while ultimately successful in bringing inflation down from its 1970s peaks, led to a sharp recession and significant increases in unemployment in the early 1980s. Inflation rates declined from double digits to average around 5% by the mid-1980s, but not without substantial economic and social costs. The government also pursued extensive supply-side reforms, including privatisation and weakening trade union power, aimed at improving the productive capacity and flexibility of the economy.

- Exchange Rate Mechanism (ERM): In the late 1980s and early 1990s, the UK attempted to use the exchange rate as an anchor for inflation by joining the European Exchange Rate Mechanism (ERM) in 1990. However, maintaining a fixed exchange rate within the ERM proved unsustainable in the face of divergent economic conditions and speculative attacks, leading to ‘Black Wednesday’ in September 1992, when the pound was forced out of the mechanism. While politically embarrassing, this event unexpectedly provided the Bank of England with the freedom to cut interest rates and stimulate the economy, simultaneously introducing an explicit inflation target.

- Inflation Targeting and MPC Independence: The post-ERM period saw the adoption of an explicit inflation target (initially 2.5% for RPIX, later 2% for CPI). The most significant institutional reform came in 1997 with the Labour government granting operational independence to the Bank of England to set interest rates to meet this target. The creation of the Monetary Policy Committee (MPC) – comprising the Governor, three Deputy Governors, and four external members – was designed to depoliticise monetary policy and enhance its credibility. This move was widely credited with anchoring inflation expectations more firmly, as markets and the public became confident that the BoE would take necessary actions to achieve its target. This era, often termed the ‘Great Moderation’, saw a period of remarkably stable and low inflation, coupled with relatively steady economic growth, attributed in part to better monetary policy frameworks and a benign global economic environment.

3.3 Post-Global Financial Crisis (2008) to Present: New Challenges and Volatility

The relative tranquility of the Great Moderation was shattered by the Global Financial Crisis (GFC) of 2008. The crisis triggered a severe recession, prompting aggressive monetary and fiscal responses globally, including in the UK.

- Post-GFC Disinflation and Recovery (2008-2015): The immediate aftermath of the GFC saw significant disinflationary pressures due to the sharp contraction in demand and widespread deleveraging. The BoE responded with drastic cuts to the Bank Rate, eventually reaching a then-historic low of 0.5%, and initiated its first round of Quantitative Easing (QE) to inject liquidity and support aggregate demand. Inflation dipped into negative territory in 2015, primarily due to falling oil prices and low wage growth, leading to concerns about deflation.

- Brexit and its Inflationary Impact (2016-2020): The UK’s decision to leave the European Union in June 2016 introduced a new layer of complexity. The immediate and significant depreciation of the Pound Sterling following the referendum result led to a sharp increase in import costs, feeding directly into consumer prices and pushing inflation above the 2% target. This was a clear example of imported cost-push inflation. Subsequent trade friction and new regulatory barriers associated with Brexit have also been cited as contributing to higher import prices and supply chain inefficiencies, adding to underlying inflationary pressures over time.

- COVID-19 Pandemic and Global Shocks (2020-2023): The COVID-19 pandemic and the subsequent global economic shutdowns and reopenings created unprecedented volatility. Initial lockdowns led to a sharp contraction in demand and disinflation. However, massive fiscal stimulus packages and accommodative monetary policies (further QE) in response to the crisis, combined with rapid shifts in consumer spending patterns towards goods, overwhelmed global supply chains. This confluence led to a surge in both demand-pull and cost-push inflation globally and in the UK as economies reopened.

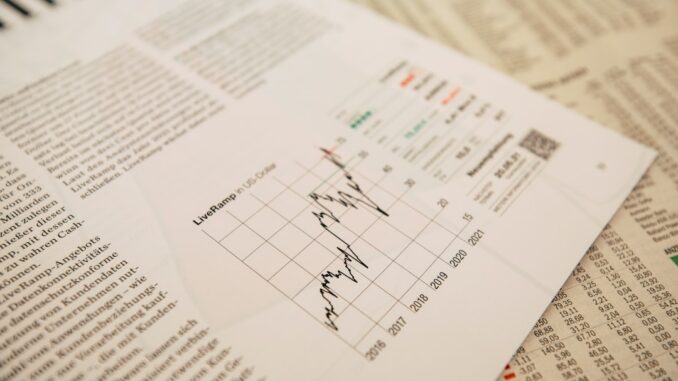

- Russia-Ukraine War and Energy/Food Crisis (2022 onwards): The invasion of Ukraine by Russia in February 2022 further exacerbated inflationary pressures. Russia’s role as a major energy supplier and Ukraine’s as a significant food exporter meant the conflict triggered dramatic spikes in global energy (gas, oil) and food commodity prices. This shock directly impacted UK households and businesses through soaring utility bills and food prices, driving headline CPI inflation to a 41-year high of 11.1% in October 2022 [ONS, CPI Annual Rate]. The BoE responded by initiating a rapid cycle of interest rate hikes, moving the Bank Rate from 0.1% to 5.25% by August 2023, the highest level since 2008, to curb persistent inflationary pressures and bring inflation back to target. This period highlighted the vulnerability of the UK economy to global supply shocks and the difficult trade-offs faced by policymakers between tackling inflation and supporting economic activity.

By early 2025, the BoE had begun to signal and implement initial rate cuts, with the Bank Rate reduced from 4.25% to 4% in August 2025 [cnbc.com]. This easing was predicated on forecasts of cooling inflation, although the path back to the 2% target remained subject to various domestic and international risks [bankofengland.co.uk, Monetary Policy Report, November 2025].

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

4. Measurement and Forecasting of Inflation

Accurate and timely measurement, alongside robust forecasting, of inflation are indispensable for effective monetary policy formulation and economic management. Without reliable data and forward-looking projections, the Bank of England’s MPC would be operating in the dark, unable to make informed decisions to meet its 2% inflation target.

4.1 Measurement of Inflation

In the UK, the primary measure of inflation, and the one targeted by the Bank of England, is the Consumer Price Index (CPI). Produced by the Office for National Statistics (ONS), the CPI aims to reflect the average change over time in the prices paid by urban consumers for a comprehensive basket of consumer goods and services.

4.1.1 The Consumer Price Index (CPI)

- Basket of Goods and Services: The CPI is constructed based on a representative ‘basket’ of goods and services typically purchased by households. This basket is meticulously updated annually to reflect changing consumption patterns and household spending habits. For example, if tablet computers become more popular, their weight in the basket increases, while the weight of declining items decreases. This ensures the index remains relevant to actual consumer experience.

- Weighting: Each item in the basket is assigned a weight based on its proportion of average household expenditure. For instance, housing, transport, and food typically have larger weights than, say, recreational goods, meaning price changes in these categories have a more significant impact on the overall CPI. Expenditure data from the Living Costs and Food Survey (LCFS) is crucial for determining these weights.

- Data Collection: Prices for approximately 700 representative goods and services are collected monthly from a vast sample of retail outlets (both physical and online) across the UK. This involves ONS field agents visiting shops, scanning online prices, and collecting data on services like utility bills and transport fares. The raw price data is then aggregated using specific formulas.

- Methodology: The CPI uses a geometric mean formula for aggregation, which is preferred by international standards (e.g., Eurostat’s Harmonised Index of Consumer Prices, HICP) as it better captures substitution effects – consumers’ tendency to switch to relatively cheaper goods when prices rise.

- Core vs. Headline Inflation: Economists often distinguish between ‘headline’ CPI, which includes all goods and services, and ‘core’ CPI, which excludes volatile items like energy, food, alcohol, and tobacco. Core inflation is considered a better indicator of underlying inflationary pressures because it filters out short-term, supply-side shocks that might not reflect broader economic trends or demand pressures.

- CPIH: The ONS also publishes CPIH, which is the CPI extended to include owner occupiers’ housing costs (OOH). OOH is a significant component of household expenditure and is estimated using a ‘rental equivalence’ approach, reflecting the cost of housing services consumed by owner-occupiers. CPIH is considered a more comprehensive measure of inflation for all households in the UK, including those who own their homes. While CPI is the BoE’s target, CPIH often provides a useful broader context.

4.1.2 The Retail Price Index (RPI)

Historically, the Retail Price Index (RPI) was the UK’s main measure of inflation. However, due to well-documented methodological shortcomings, including its use of an arithmetic mean (which tends to overstate inflation, especially when prices are volatile) and issues with formula effect, it has been largely superseded by the CPI. The ONS ceased designating RPI as a National Statistic in 2013, and while it continues to be published (primarily due to its use in long-term contracts, index-linked gilts, and some public sector pensions), it is no longer the preferred measure for economic analysis or policy targeting. The government announced plans in 2020 to align RPI with CPIH from 2030, a move that will effectively phase out RPI as a distinct measure.

4.1.3 Producer Price Index (PPI)

While not a measure of consumer inflation, the Producer Price Index (PPI) measures price changes from the perspective of the producer. It tracks the average change in prices received by domestic producers for their output (output PPI) and the average change in prices paid by domestic producers for their inputs (input PPI). PPI can serve as an early indicator of future consumer inflation, as rising input costs for businesses often get passed on to consumers.

4.2 Forecasting of Inflation

Inflation forecasting is a complex, data-intensive, and inherently uncertain process that lies at the heart of the Bank of England’s monetary policy framework. The MPC relies on a suite of sophisticated models and expert judgement to project future inflation trends, typically over a two to three-year horizon, which is the relevant time frame for monetary policy’s impact.

4.2.1 Econometric Models

The BoE employs a variety of econometric models, each with different strengths and assumptions:

- Phillips Curve Models: These models explore the relationship between inflation, unemployment (or output gap), and inflation expectations. They capture the idea that when the economy is operating above its potential, labour markets tighten, leading to wage pressure and ultimately higher inflation. Modern Phillips curve models incorporate factors like import prices and global output gaps.

- Vector Autoregression (VAR) Models: VAR models treat all variables as endogenous, allowing them to capture dynamic interdependencies between a range of economic indicators (e.g., interest rates, exchange rates, output, inflation, money supply). They are useful for analysing short-to-medium-term relationships and generating impulse responses to shocks.

- Dynamic Stochastic General Equilibrium (DSGE) Models: These are highly complex, theory-driven models that attempt to micro-found macroeconomic relationships. They are built on assumptions about optimising behaviour of households and firms and can be used to simulate the economy’s response to various shocks and policy changes. DSGE models provide a structural understanding of inflation dynamics but can be sensitive to their underlying assumptions.

- Bayesian Model Averaging: The BoE also uses techniques like Bayesian model averaging, where forecasts are combined from multiple models, weighting them according to their historical performance and theoretical plausibility. This helps to account for model uncertainty.

4.2.2 Key Economic Indicators and Data Inputs

Forecasting models are fed with a vast array of economic data and indicators, including:

- Demand-Side Indicators: GDP growth, consumer spending, business investment, government expenditure, housing market activity, credit growth.

- Supply-Side Indicators: Unemployment rates, wage growth, labour force participation, capacity utilisation, productivity growth.

- External Factors: Global commodity prices (especially oil and gas), exchange rates, global growth forecasts, international trade volumes.

- Inflation Expectations: These are crucial. The BoE monitors various measures of inflation expectations, including:

- Surveys of households, businesses, and professional forecasters (e.g., BoE/NMG household survey, Consensus Economics).

- Market-based measures derived from inflation-linked gilts (e.g., break-even inflation rates).

- Inflation expectations inform the ‘built-in’ component of inflation and can significantly influence actual price setting and wage bargaining behaviour.

- Monetary Aggregates: Growth in broad money supply (M4) and narrow money (M0), although the direct link to inflation is less prominent in modern monetary policy.

4.2.3 The Bank of England’s Forecasting Process

Each quarter, the Bank of England publishes its detailed Monetary Policy Report (MPR), which includes the MPC’s official inflation and growth forecasts. These forecasts are presented as ‘fan charts’, which illustrate the MPC’s central projection alongside the probability distribution of possible outcomes, reflecting the inherent uncertainty in forecasting. The width of the ‘fan’ indicates the degree of uncertainty.

Forecasting is not purely mechanistic; it also involves significant expert judgement from MPC members. They interpret model outputs, incorporate real-time intelligence, and assess the qualitative impact of unquantifiable factors (e.g., geopolitical risks, shifts in sentiment). The MPC then debates the forecasts and determines the appropriate stance for monetary policy (e.g., whether to raise, cut, or hold the Bank Rate) to steer inflation back to the 2% target. The two-year horizon is particularly important because monetary policy decisions typically take 18-24 months for their full effects to be felt in the economy.

4.2.4 Challenges in Forecasting

Inflation forecasting is fraught with challenges:

- Model Uncertainty: No single model perfectly captures the complexity of the economy. Different models can produce different forecasts.

- Data Lags and Revisions: Economic data is often released with a lag and subject to revision, meaning forecasts are often based on incomplete or preliminary information.

- Unforeseen Shocks: Large, unpredictable events (e.g., pandemics, wars, natural disasters) can rapidly alter economic conditions and render previous forecasts obsolete.

- Non-Linearities: Economic relationships are not always linear; small changes can sometimes trigger disproportionately large effects.

- Changes in Economic Structure: The underlying structure of the economy can evolve (e.g., globalisation, technological advancements), making historical relationships less reliable for forecasting.

Despite these challenges, continuous refinement of models, incorporation of new data sources, and the application of expert judgment enable the BoE to make the most informed decisions possible in its quest for price stability.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

5. Monetary Policy Tools for Managing Inflation

Monetary policy, primarily conducted by the Bank of England (BoE) through its Monetary Policy Committee (MPC), is the principal instrument for managing inflation in the UK. The MPC meets eight times a year (and more frequently if necessary) to decide on the appropriate stance of monetary policy, guided by its 2% inflation target. The key tools at its disposal influence the availability and cost of money and credit in the economy, thereby impacting aggregate demand and ultimately prices.

5.1 Bank Rate Adjustments (Policy Rate)

The Bank Rate, also known as the base rate or official interest rate, is the single most prominent monetary policy tool. It represents the interest rate at which the Bank of England lends to commercial banks (and pays interest on their reserves held at the BoE). Changes to the Bank Rate transmit throughout the economy via several channels, influencing borrowing, saving, and investment decisions, and ultimately affecting inflationary pressures.

5.1.1 Transmission Channels of Bank Rate Changes

When the BoE adjusts the Bank Rate, its effects propagate through the economy via several key transmission channels:

-

Interest Rate Channel:

- Borrowing Costs: An increase in the Bank Rate typically leads commercial banks to raise their own lending rates (e.g., mortgage rates, personal loan rates, business loan rates). This makes borrowing more expensive for households and firms, discouraging consumption of durable goods (like cars and appliances) and reducing business investment. Conversely, a cut in the Bank Rate lowers borrowing costs, stimulating spending and investment.

- Saving Incentives: Higher interest rates make saving more attractive, encouraging households to defer consumption. Lower rates reduce the incentive to save, potentially encouraging more immediate spending.

-

Asset Price Channel:

- Bond Prices: Higher interest rates generally lead to lower bond prices, as existing bonds with lower fixed interest payments become less attractive relative to new bonds offering higher yields.

- Equity Prices: Higher interest rates can reduce the present value of future corporate earnings, potentially dampening equity prices. A weaker stock market can reduce household wealth, leading to a ‘negative wealth effect’ on consumer spending.

- Housing Market: Mortgage rates are directly affected by the Bank Rate. Higher rates increase mortgage costs, dampening housing demand and potentially leading to slower house price growth or even declines. This also impacts household wealth and confidence.

-

Exchange Rate Channel:

- Capital Flows: Higher domestic interest rates relative to those abroad can attract foreign capital, as investors seek higher returns. This increased demand for the domestic currency (Pound Sterling) leads to its appreciation.

- Import/Export Prices: An appreciated currency makes imports cheaper (reducing imported inflation) and exports more expensive (reducing foreign demand for UK goods). This impacts the aggregate demand component of net exports and directly influences the prices of imported goods that feed into the CPI.

-

Credit Channel:

- Bank Lending: Higher Bank Rates can make it more expensive for banks to fund their lending, potentially leading to tighter credit conditions (e.g., stricter lending criteria, reduced loan availability). This directly impacts the supply of credit to the economy.

- Balance Sheet Effects: For firms and households with significant variable-rate debt, higher interest rates directly reduce their disposable income and cash flow, potentially impacting their ability to spend and invest.

-

Expectations Channel:

- Inflation Expectations: By clearly communicating its commitment to the 2% target and taking decisive action through Bank Rate changes, the BoE influences public and market expectations about future inflation. If people believe the BoE will control inflation, they are less likely to demand excessive wage increases or raise prices, helping to prevent built-in inflation (wage-price spiral). Credible forward guidance enhances this channel’s effectiveness.

5.1.2 Recent Bank Rate Adjustments

Following a prolonged period of ultra-low rates post-GFC and during COVID-19, the BoE embarked on an aggressive tightening cycle from late 2021 to mid-2023 to combat surging inflation. The Bank Rate rose from 0.1% in December 2021 to a peak of 5.25% by August 2023. This rapid increase aimed to cool an overheating economy and bring inflation back to target. By mid-2024 and into 2025, as inflationary pressures began to recede and economic growth moderated, the MPC started to signal and implement rate cuts. For instance, in August 2025, the BoE cut the Bank Rate from 4.25% to 4%, marking the first reduction in over two years [cnbc.com, 2025]. Further cuts were anticipated, contingent on inflation continuing its downward trajectory [bankofengland.co.uk, Monetary Policy Report, November 2025].

5.2 Quantitative Easing (QE) and Quantitative Tightening (QT)

When conventional monetary policy (Bank Rate adjustments) reaches its effective lower bound (close to zero), central banks may resort to unconventional tools like Quantitative Easing (QE) to provide further stimulus. Its reverse, Quantitative Tightening (QT), unwinds these policies.

5.2.1 Quantitative Easing (QE)

QE involves the large-scale purchase of government bonds (and sometimes corporate bonds) by the central bank from commercial banks and other financial institutions. The primary objectives are:

- Injecting Liquidity: By purchasing assets, the BoE injects reserves into the banking system, increasing the money supply and liquidity available for lending.

- Lowering Long-Term Interest Rates: QE increases demand for bonds, pushing up their prices and consequently lowering their yields. Since long-term interest rates (e.g., for mortgages and corporate debt) are often linked to long-term government bond yields, QE helps to reduce borrowing costs across the economy, even when the Bank Rate is at its lower bound.

- Portfolio Balance Effect: As banks sell bonds to the BoE, they receive cash. They may then use this cash to buy other assets (e.g., corporate bonds, equities), driving up asset prices and lowering yields across a broader range of financial markets. This can stimulate investment and consumption through wealth effects.

- Confidence Effect: QE can signal the central bank’s strong commitment to supporting the economy, boosting business and consumer confidence.

QE was extensively used by the BoE following the 2008 GFC and again during the COVID-19 pandemic, with total asset purchases reaching over £875 billion [bankofengland.co.uk]. Its aim was to prevent deflation and stimulate aggregate demand when the Bank Rate could not be lowered further.

5.2.2 Quantitative Tightening (QT)

Quantitative Tightening (QT) is the reverse of QE, aiming to reduce the size of the central bank’s balance sheet and withdraw liquidity from the financial system. This can occur in two ways:

- Passive QT: Allowing purchased bonds to mature without reinvesting the proceeds. This gradually shrinks the balance sheet.

- Active QT: Actively selling bonds back into the market before maturity.

QT aims to put upward pressure on long-term interest rates and withdraw liquidity, thereby dampening aggregate demand and combating inflation. The BoE began its QT programme in 2022, initially through passive non-reinvestment and later, from late 2022, through active bond sales, as inflation soared.

5.3 Forward Guidance

Forward guidance involves the central bank communicating its future policy intentions, often linking policy decisions to specific economic conditions or forecasts, to influence market expectations and economic behaviour. This tool aims to enhance the effectiveness of conventional and unconventional monetary policies.

- Mechanism: By providing clarity on the likely future path of the Bank Rate or QE, forward guidance helps to anchor long-term interest rates, as financial markets adjust their expectations. It reduces uncertainty, making it easier for businesses and households to plan their spending and investment decisions.

- Types:

- Time-based Guidance: Committing to keeping rates low for a specific period (e.g., ‘until X date’). This was less common due to inherent uncertainties.

- State-contingent Guidance: More prevalent, where policy is tied to specific economic thresholds (e.g., ‘rates will remain low until unemployment falls below Y%’ or ‘until inflation is sustainably back at target’). The BoE used state-contingent guidance after the GFC and during the COVID-19 pandemic.

- Effectiveness: For forward guidance to be effective, it must be credible. Markets and the public must believe that the central bank will stick to its stated intentions, even if short-term conditions change. Clear communication and a strong track record of meeting targets are essential.

5.4 Other Monetary Policy Tools

While less frequently used for day-to-day inflation management, other tools complement the BoE’s framework:

- Macroprudential Tools: The Financial Policy Committee (FPC), a separate committee within the BoE, is responsible for macroprudential policy. It aims to identify and mitigate systemic risks to financial stability. While not directly targeting inflation, financial stability is a prerequisite for effective monetary policy. Tools include counter-cyclical capital buffers for banks, loan-to-value (LTV) limits for mortgages, or debt-to-income (DTI) limits. By preventing excessive credit growth and asset bubbles, these tools indirectly contribute to overall economic stability and prevent financial imbalances from feeding into inflationary pressures or requiring drastic monetary policy interventions later.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

6. Fiscal Policy Tools for Managing Inflation

While monetary policy is the primary domain of the Bank of England for managing inflation, fiscal policy, controlled by His Majesty’s Treasury and Parliament, plays a crucial complementary role. Fiscal policy refers to the government’s decisions regarding taxation and public spending, which directly influence aggregate demand and the overall economy. When used counter-cyclically, fiscal tools can either stimulate an economy facing deflationary risks or cool an economy experiencing inflationary pressures.

6.1 Taxation

Adjustments to various tax rates can significantly influence disposable income, consumption patterns, and investment decisions, thereby impacting aggregate demand and inflationary pressures. The specific type of tax adjusted will determine the magnitude and distribution of its effect.

-

Direct Taxes: These are levied on income and profits.

- Income Tax: Increasing income tax rates (e.g., the basic or higher rate) reduces households’ disposable income. With less money available for spending, consumer demand is likely to fall, which can help to dampen demand-pull inflationary pressures. Conversely, tax cuts aim to stimulate demand.

- Corporation Tax: An increase in corporation tax reduces companies’ after-tax profits. This can diminish their incentive to invest and expand, potentially cooling an overheating economy. However, it can also deter foreign direct investment and reduce long-term growth potential if maintained for too long. Alternatively, tax breaks can encourage investment and supply-side growth, potentially easing future supply constraints.

- National Insurance Contributions (NICs): Changes to NICs for employees and employers affect labour costs and disposable income, impacting both wage-push and demand-pull factors.

-

Indirect Taxes: These are levied on goods and services, often impacting prices more directly.

- Value Added Tax (VAT): Increasing the standard rate of VAT (currently 20% in the UK) directly raises the prices of most goods and services, which can have an immediate, though often temporary, upward impact on the measured CPI. However, by making goods and services more expensive, it also dampens consumer spending, thereby reducing underlying demand-pull pressures. Conversely, a temporary cut in VAT (as seen during the 2008 financial crisis) aims to stimulate consumption.

- Excise Duties: Taxes on specific goods like fuel, alcohol, and tobacco directly raise their prices. While often used for revenue generation or public health objectives, changes can also impact inflation, particularly for items with significant weights in the CPI basket (e.g., fuel).

- Environmental Taxes: Carbon taxes or levies on polluting activities can increase production costs for some firms, which may be passed on to consumers. While aimed at environmental goals, they can contribute to cost-push inflation.

6.2 Government Spending

Modifying the level and composition of public expenditure is another powerful fiscal tool. Government spending directly contributes to aggregate demand (G in the AD=C+I+G+NX equation) and can also influence the supply side of the economy.

- Current Spending: This includes public sector wages, social welfare payments (e.g., unemployment benefits, state pensions), and the day-to-day running costs of government services (e.g., NHS, education). Reducing current spending can directly lower aggregate demand, helping to curb demand-pull inflation. Conversely, increased welfare payments can support demand during downturns, but if excessive in a booming economy, they can contribute to inflationary pressures.

- Capital Spending (Public Investment): This involves expenditure on infrastructure projects such as roads, railways, schools, hospitals, and digital networks. In the short term, increased capital spending boosts aggregate demand through the construction sector and related industries. In the long term, however, well-targeted public investment can enhance the economy’s productive capacity, improve supply-side efficiency, and potentially help to alleviate future supply constraints that could lead to cost-push inflation. For instance, investing in renewable energy infrastructure can reduce reliance on volatile fossil fuel imports.

- Automatic Stabilisers: These are elements of the government’s budget that automatically adjust to economic fluctuations without explicit policy decisions. Examples include:

- Unemployment Benefits: In a recession, more people claim benefits, increasing government spending and supporting aggregate demand. In a boom, fewer people claim, reducing spending.

- Progressive Taxation: In a boom, higher incomes mean more tax revenue, acting as a brake on demand. In a downturn, incomes fall, reducing tax liabilities and cushioning the drop in disposable income.

When inflation is high, a government might pursue fiscal austerity – reducing spending and/or increasing taxes – to dampen aggregate demand. Conversely, during periods of low inflation or deflationary threats, fiscal stimulus (increased spending and/or tax cuts) can be deployed to boost demand. The size of the government’s budget deficit or surplus is a key indicator of its fiscal stance.

6.3 Subsidies and Price Controls

These are more direct and often more interventionist fiscal measures that can impact inflation, though they are typically used sparingly due to potential market distortions.

- Subsidies: Governments can provide financial assistance (subsidies) to producers of essential goods or services (e.g., energy, public transport, food staples). This can lower the production costs for firms, which may then be passed on to consumers in the form of lower prices. Subsidies can therefore directly reduce the measured CPI for those specific items. Examples include government support for energy bills during a crisis. However, subsidies have a fiscal cost (adding to public debt or requiring higher taxes elsewhere), can distort market signals, and may lead to inefficient resource allocation if not carefully designed.

- Price Controls: These involve setting maximum legal prices for certain goods or services. Historically, price controls have been used during wartime or periods of severe hyperinflation (e.g., in the UK during the 1970s through ‘incomes policies’ that tried to cap wages and prices). While they can temporarily suppress headline inflation, they often lead to unintended consequences such as shortages (as producers face reduced incentives to supply at artificially low prices), black markets, reduced quality, and a disincentive for investment in the controlled sectors. Most economists view price controls as an inefficient and often counterproductive long-term solution for managing inflation.

6.4 Challenges of Fiscal Policy in Managing Inflation

While powerful, fiscal policy faces several challenges in effectively managing inflation:

- Political Lags: Changes to taxation and government spending often require parliamentary approval, making the decision-making and implementation process slower and more susceptible to political considerations than monetary policy.

- Crowding Out: Expansionary fiscal policy, particularly when financed by government borrowing, can increase the demand for loanable funds, potentially driving up interest rates. This can ‘crowd out’ private sector investment, reducing the stimulatory effect of the fiscal policy.

- Public Debt: Persistent budget deficits stemming from expansive fiscal policy can lead to an accumulation of public debt, which may raise concerns about long-term fiscal sustainability and require future austerity measures.

- Supply-Side Effects: While fiscal policy primarily targets aggregate demand, tax changes or specific spending programmes (e.g., infrastructure) can have significant long-term supply-side effects. These effects are often harder to predict and take longer to materialise.

- Information Lags: Governments face challenges in accurately assessing the state of the economy and the appropriate magnitude of fiscal intervention, potentially leading to over- or under-stimulation.

In practice, effective inflation management often requires careful coordination between independent monetary policy (BoE) and government fiscal policy, especially during severe economic downturns or periods of extreme inflationary pressure.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

7. Effectiveness and Side Effects of Policy Tools

Both monetary and fiscal policy tools possess distinct strengths in addressing inflation, but their application is not without trade-offs and potential unintended consequences. Policymakers must carefully weigh these factors to achieve the desired macroeconomic stability without unduly destabilising other parts of the economy or society.

7.1 Monetary Policy

Monetary policy, under the remit of the Bank of England’s independent MPC, is generally considered the primary and most flexible tool for short-to-medium-term inflation management.

7.1.1 Effectiveness of Monetary Policy

- Speed of Adjustment and Flexibility: The MPC can adjust the Bank Rate relatively quickly, often with immediate market reactions. Decisions can be made every six weeks, allowing for agile responses to evolving economic conditions. This flexibility contrasts with fiscal policy, which often faces longer legislative lags.

- Independence from Political Cycles: The BoE’s operational independence from the government means monetary policy decisions are primarily based on economic analysis and the inflation target, rather than short-term political expediency. This enhances credibility and helps to anchor inflation expectations.

- Strong Influence on Inflation Expectations: Through clear communication (forward guidance) and consistent action, the BoE can effectively influence public and market expectations about future inflation. Well-anchored expectations reduce the likelihood of self-fulfilling wage-price spirals, making it easier to achieve the inflation target with less disruptive policy actions.

- Broad Reach: Changes in the Bank Rate and liquidity conditions affect virtually all sectors of the economy through the various transmission channels (interest rates, credit, asset prices, exchange rates).

- QE for Extreme Conditions: In periods of severe economic distress and at the zero lower bound for interest rates, QE has proven effective in providing additional monetary stimulus, supporting asset prices, and preventing deflation, thereby avoiding a deeper economic downturn.

7.1.2 Side Effects of Monetary Policy

- Distributional Impacts:

- Savers vs. Borrowers: Higher interest rates generally benefit savers by increasing returns on deposits but disadvantage borrowers through higher debt servicing costs (especially those with variable-rate mortgages). Conversely, low rates (e.g., during QE) penalise savers and reward borrowers.

- Asset Holders vs. Non-Asset Holders: QE, by driving up asset prices (stocks, bonds, housing), disproportionately benefits those who own significant assets, typically wealthier individuals. This can exacerbate income and wealth inequality, a frequently cited critique of QE programmes.

- Risk of Financial Instability: Prolonged periods of exceptionally low interest rates can encourage excessive risk-taking by investors and financial institutions (‘search for yield’). This can lead to the formation of asset bubbles (e.g., in housing or equity markets) or the accumulation of unsustainable debt, posing risks to financial stability that might require macroprudential intervention or, if left unchecked, could trigger a financial crisis.

- Exchange Rate Volatility: Monetary policy changes can significantly impact the exchange rate, particularly if a country’s interest rates diverge from those of major trading partners. While an appreciated currency helps dampen imported inflation, it can harm export-oriented industries by making their goods more expensive abroad, potentially impacting economic growth and employment.

- Time Lags: Monetary policy operates with significant and variable time lags (typically 18-24 months for its full effect on inflation). This makes policymaking challenging, as the MPC must forecast future conditions and act preemptively, often with incomplete information.

- Zero Lower Bound (ZLB) and Liquidity Trap: Conventional interest rate policy becomes constrained when the policy rate approaches zero. In a ‘liquidity trap’, even further reductions in interest rates or increases in the money supply may not stimulate aggregate demand, as individuals and businesses prefer to hoard cash. This limits the effectiveness of traditional monetary policy and necessitates unconventional tools like QE.

7.2 Fiscal Policy

Fiscal policy, though often slower to implement, offers direct levers to influence specific sectors or groups and can complement monetary policy, particularly during severe economic downturns.

7.2.1 Effectiveness of Fiscal Policy

- Direct Impact on Specific Sectors/Groups: Fiscal policy can be highly targeted. For example, specific tax breaks can be aimed at particular industries, or direct transfer payments can support vulnerable households. This allows for a more granular approach to demand management or supply-side enhancement than broad monetary policy changes.

- Complementary to Monetary Policy: In situations where monetary policy is constrained (e.g., at the ZLB), expansionary fiscal policy can provide much-needed aggregate demand stimulus to combat deflation or a deep recession. During high inflation, fiscal austerity can reinforce monetary tightening.

- Addressing Supply-Side Issues: Government spending on infrastructure (e.g., transport, energy, digital networks), education, or R&D can enhance the economy’s productive capacity, improve efficiency, and reduce long-term cost pressures. These supply-side investments are crucial for sustainable non-inflationary growth.

- Automatic Stabilisers: Elements of fiscal policy (like unemployment benefits and progressive taxation) automatically cushion economic shocks, reducing the amplitude of business cycles without requiring explicit policy decisions.

7.2.2 Side Effects of Fiscal Policy

- Political Economy Issues and Implementation Lags: Fiscal decisions are inherently political, often involving contentious debates in Parliament. This leads to significant decision lags and implementation lags. By the time a fiscal measure is enacted, economic conditions may have changed, potentially making the policy pro-cyclical (exacerbating rather than smoothing the cycle).

- Crowding Out: Expansionary fiscal policy, especially if financed by increased government borrowing, can increase the demand for loanable funds in financial markets. This can put upward pressure on interest rates, potentially ‘crowding out’ private sector investment and consumption. The extent of crowding out is debated but can reduce the overall effectiveness of fiscal stimulus.

- Public Debt and Sustainability Concerns: Persistent budget deficits lead to an accumulation of public debt. High levels of government debt can impose a burden on future generations, potentially requiring higher taxes or reduced public services. Concerns about debt sustainability can also erode investor confidence and lead to higher borrowing costs for the government itself.

- Distortionary Effects: Taxation can distort economic incentives. High income taxes might discourage work or entrepreneurship, while corporate taxes can deter investment. Subsidies, while lowering prices, can create market distortions, reduce competition, and lead to inefficient allocation of resources if not carefully managed.

- Information Problems: Governments face challenges in accurately forecasting the impact of specific fiscal measures. The size of the ‘fiscal multiplier’ (the change in national income resulting from a change in government spending or taxes) is uncertain and can vary depending on economic conditions.

In sum, both monetary and fiscal policies are powerful but imperfect instruments. Their optimal application requires careful consideration of their mechanisms, transmission channels, timing, and potential side effects, often in a complex and uncertain economic environment. A coordinated approach, where fiscal policy provides longer-term structural support and demand management, while monetary policy focuses on short-to-medium-term price stability, is generally considered the most effective strategy for promoting overall economic stability and prosperity.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

8. Conclusion

Effective inflation management in the United Kingdom necessitates a dynamic and intricate balancing act, harmonising the imperative to control price rises with the equally vital objective of fostering sustainable economic growth and employment. The Bank of England, through its independent Monetary Policy Committee, stands at the forefront of this endeavour, wielding a sophisticated array of monetary policy tools, notably Bank Rate adjustments, quantitative easing/tightening, and forward guidance. These instruments are designed to influence aggregate demand and inflation expectations across the economy, demonstrating considerable efficacy in their intended function of steering inflation towards the 2% target.

Alongside monetary policy, the government’s fiscal measures, encompassing adjustments to taxation, government spending, and occasionally more direct interventions like subsidies, play a crucial, albeit often complementary, role. Fiscal policy can directly influence aggregate demand and, importantly, address longer-term supply-side issues through strategic investment, thereby enhancing the economy’s productive capacity and mitigating future inflationary pressures. The interplay between these two powerful policy levers is critical; while monetary policy typically offers greater agility and independence for short-to-medium-term stabilisation, fiscal policy can provide targeted support and address structural challenges that lie beyond the direct reach of interest rates.

However, the deployment of these instruments is not without its complexities and potential drawbacks. Monetary policy, particularly through aggressive rate hikes or large-scale asset purchases, carries risks of distributional inequality, affecting savers and borrowers differently, and potentially contributing to asset price bubbles. Its effects also operate with significant time lags, demanding foresight and often proactive measures from policymakers. Similarly, fiscal policy, while capable of targeted impact, is often hampered by political lags, the risk of ‘crowding out’ private investment, and concerns regarding public debt sustainability. Unintended consequences, such as market distortions from subsidies or the creation of black markets from price controls, necessitate cautious and evidence-based application.

The historical trajectory of inflation in the UK vividly illustrates these challenges, from the stagflationary crises of the 1970s driven by oil shocks and wage-price spirals, to the ‘Great Moderation’ ushered in by inflation targeting, and the recent resurgence of inflation spurred by global supply chain disruptions, energy shocks, and geopolitical conflicts. Each era has underscored the adaptive nature required of economic policy.

A nuanced understanding of these intricate dynamics – the interplay of different inflation types, the mechanisms of policy transmission, and the associated trade-offs – is therefore absolutely essential for developing robust and resilient economic strategies. Looking ahead, future challenges such as the economic implications of climate change, increasing geopolitical fragmentation, rapid technological shifts, and demographic changes (e.g., ageing populations and their impact on labour markets and productivity) will continue to shape the inflationary landscape. Policymakers must continually refine their analytical frameworks, foster effective coordination between monetary and fiscal authorities, and maintain unwavering credibility in their commitment to price stability to navigate these evolving complexities. The ultimate goal remains to cultivate an environment of economic stability and sustainable prosperity for all citizens of the United Kingdom.

Many thanks to our sponsor Focus 360 Energy who helped us prepare this research report.

References

- Bank of England. (2025). Monetary Policy Report – November 2025. Retrieved from bankofengland.co.uk

- Bank of England. (2024). Monetary Policy Report – November 2024. Retrieved from bankofengland.co.uk

- Bank of England. (2024). Bank of England Governor Forecasts Four UK Rate Cuts in 2025 as Inflation Drops. [Video]. FT Live. Retrieved from youtube.com

- Bank of England. (2024). Bank of England cuts rates from 16-year high, careful on next move. [Video]. REUTERS. Retrieved from youtube.com

- CNBC. (2025, August 7). Bank of England cuts interest rates by a quarter point to 4%. Retrieved from cnbc.com

- CNBC. (2024, December 4). Bank of England’s Bailey signals four interest rate cuts in 2025 if inflation cools. Retrieved from cnbc.com

- Euronews. (2025, February 6). Bank of England cuts key interest rate as pound drops and stocks rally. Retrieved from euronews.com

- Euronews. (2025, September 18). Bank of England holds main UK interest rate at 4% with inflation above target. Retrieved from euronews.com

- Investing.com. (2025, November 16). Bank of England cuts rates and growth outlook, sees inflation ‘bump’. Retrieved from investing.com

- Office for National Statistics. (n.d.). Consumer price inflation, UK: 1950 to 2023. Retrieved from ons.gov.uk

- Wikipedia. (n.d.). Monetary Policy Committee (United Kingdom). Retrieved from en.wikipedia.org

- Woodford, M. (2003). Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton University Press.

Be the first to comment